Client Segmentation for Financial Advisors

As a financial advisor, you manage diverse client relationships, but are you treating every client the same? If so, you’re missing a strategic opportunity to boost efficiency, deepen relationships, and accelerate organic growth.

Client segmentation is not just organizing, it is a directional, client-centric approach that can transform your practice.

At GCG Advisory Partners, we understand how powerful a deliberate segmentation strategy can be in driving organic growth. We created this guide to share best practices and practical steps to help you implement a model that aligns with your firm’s goals.

Why Financial Advisors Need Client Segmentation

Too many advisors try to be everything to everyone, which often feels impersonal and overwhelming.

Segmentation helps clarify who your clients are, what they need, and in turn you learn how to best serve them. Think of it as a strategic roadmap delivering a consistently referrable experience clients will want to talk about.

But don’t just take our word for it, other advisors agree:

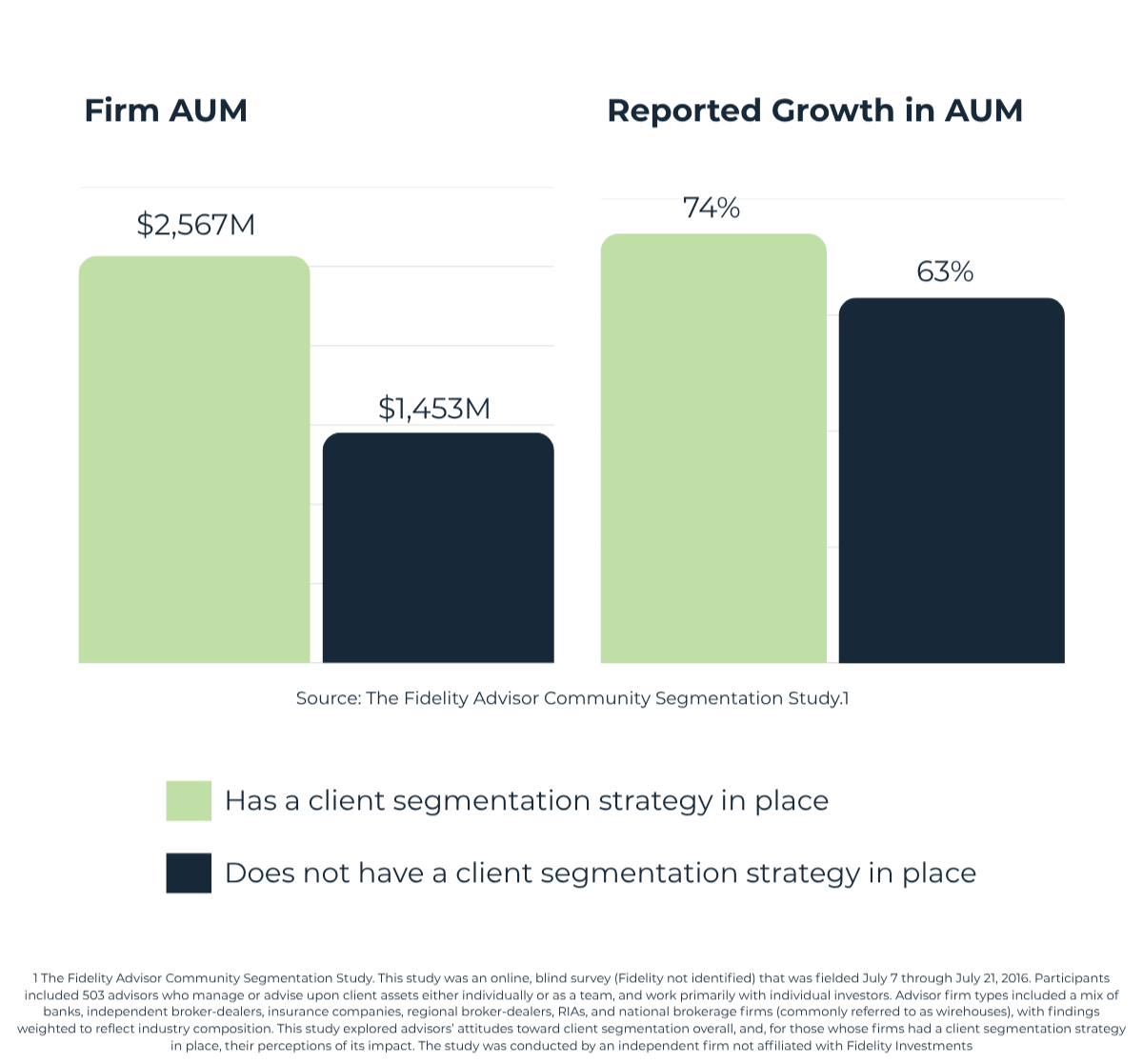

Still don’t believe us…

Well, it’s true; the numbers speak for themselves. When you take a more intentional approach, segment your clients, and align your services accordingly, tangible results follow:

Enhanced Client Experience & Retention

Smarter Resource Allocation

Identification of Clients That Drive Growth

Improved Practice Economics

Now, let’s explore how segmentation works and how you can begin implementing it within your practice.

Building a Client Segmentation Strategy

Before developing your segmentation strategy, ensure you have a clear understanding of your firm’s objectives, resources, and capacity. Set goals that are both ambitious and attainable, while maintaining uninterrupted client service throughout the process.

Though gathering data and building the right systems takes time, this intentional groundwork establishes a foundation for sustainable growth and lasting results.

Step 1: Define Your Goals

Clarify why you’re segmenting: capacity constraints, differentiated service, identifying poor-fit clients, or improving client experience.

Conduct an 80/20 analysis—you’ll likely find 80% of your revenue comes from 20% of clients. Use this to demonstrate why segmentation matters to your team.

Step 2: Build and Maintain Quality Data

Your CRM is the engine that powers effective segmentation. Capture both quantitative data (AUM, revenue, product usage) and qualitative insights (goals, communication preferences, interests, and life events) directly within your CRM.

Establish standardized fields, tags, and workflows so your data can be easily leveraged for targeted campaigns, event invitations, and personalized communications.

Consistently maintain and update this information to ensure that you have reliable, high-quality data to accurately evaluate and segment your clients.

Step 3: Design Service Tiers

Establish clear service levels (e.g., Premier, Preferred, Core, Standard) to define the level of attention, communication, and engagement you dedicate to each client relationship. These tiers should reflect the overall value each client brings to the firm—financially and strategically.

You’ll identify your specific value criteria in the next step, but for now, consider the following examples of how to differentiate your service offerings:

Tax coordination: Top-tier clients get proactive CPA collaboration; lower tiers receive summary reports.

Access: Premier clients have direct advisor access; others use a service team line.

Planning depth: Higher tiers include estate and legacy planning; lower tiers focus on core goals.

Step 4: Score and Classify Clients

Most successful firms segment using multiple factors. The five most common criteria include:

Client Profitability & Revenue: The actual revenue each relationship generates today.

Assets Under Management (AUM): Total investable assets currently managed.

Service Requirements & Time Investment: Resources needed to maintain the relationship.

Future Revenue Potential: Opportunities for additional wallet share or growth.

Specific Financial Planning Needs: Specialized services required by each client.

Once you’ve identified the factors that matter most to your practice, you can select the segmentation method that best aligns with your objectives.

Remember, segmentation can be qualitative, quantitative, or a blend of both. The more detailed your approach, the greater the need for structure and discipline to ensure effective execution.

The three primary segmentation models include:

Single Factor Ranking

Rank clients by a single factor—usually revenue or AUM—to quickly identify who drives the majority of firm income. This is simple but limited; it doesn’t capture growth potential or relationship quality.

Weighted Score Ranking (Best Practice)

Assign weighted scores to multiple attributes—such as 40% revenue, 30% potential revenue, 20% referrals, 10% relationship quality—to calculate a composite score. This multidimensional approach provides a more accurate picture of client value and prioritization.

Use a spreadsheet to calculate weighted scores based on key factors, then sort by total score to identify natural tier groupings.

Behavioral Segmentation

This method is the most personalized and the most time intensive. It involves segmenting clients based on their attitudes, behaviors, interests, and life stages, allowing advisors to tailor planning, communication, and experiences that deepen loyalty and retention.

To do this effectively, you must consistently capture insights beyond financial data—understanding who your clients are, what they value, and how they prefer to engage.

Although time-consuming, this approach builds meaningful relationships and demonstrates genuine care and understanding, something clients will undoubtedly notice.

Once you’ve completed your client segmentation, you can assign each client to the appropriate service tier identified in the previous step.

Step 5: Transition Clients Thoughtfully

Reassigning clients or adjusting your service model can still feel sensitive, even within a smaller team. Use data and clear reasoning to guide these decisions, ensuring clients understand that any change is designed to enhance their experience—not reduce attention. Do not make clients feel as though they are being downgraded, phrase the transition as a plan that is “more customized to them”.

Best practices include communicating proactively, setting clear expectations for service levels, and leveraging your support staff strategically so each client continues to feel valued and well cared for.

Common Pitfalls to Avoid

Over-complicating the scoring model: Focus on what truly matters—revenue, potential, and workload.

Weak data infrastructure: Segmentation without reliable CRM data is unsustainable. In consistency with tags and labels can also cause confusion.

Poor change management: Present segmentation as customization, not hierarchy.

Mismatched advisor transitions: Always ensure transitioned clients receive equal or greater service quality.

How to Measure Your Success

Track KPIs aligned with your goals:

Efficiency: Time allocation, meetings per client, service turnaround times.

Growth: AUM growth by tier, client consolidation rates, new acquisitions.

Profitability: Revenue per client, margin by tier, advisor comp vs. book mix.

Client Experience: NPS, retention, and referral activity.

Capacity: Clients per advisor and time available for business development.

The Bottom Line: Client Segmentation Drives Growth for Financial Advisors

Client segmentation turns an advisory practice from reactive to strategic. It’s both art and science—blending data-driven insight with human understanding.

Firms that commit to segmentation see stronger client relationships, higher profitability, and scalable growth—without overwhelming advisors or increasing overhead.

The question isn’t whether to segment your clients—it’s how quickly you can start. Audit your current client base, analyze your top revenue drivers, and standardize your CRM data collection. With a thoughtful, consistent approach, segmentation will become one of your firm’s most valuable growth levers.

At GCG Advisory Partners, we help advisors implement proven strategies like this to strengthen client engagement, drive efficiency, and accelerate organic growth. Connect with our team to learn how strategic segmentation can elevate your practice.

Source: ¹Fidelity Investments. (2017). Segment for Success: Secrets from Firms Doing Client Segmentation. Fidelity