Bridging the Gap: Overcoming G1 and G2 Misalignment in Advisory Firm Succession

In the financial advisory world, succession isn’t just a milestone—it’s a defining moment in a firm’s legacy. But far too often, succession planning stalls, fractures, or fails altogether due to one core issue: misalignment between G1 (first-generation founders) and G2 (next-generation successors).

This misalignment isn’t always loud. It doesn’t always show up as outright conflict. More often, it’s subtle—unspoken assumptions, mismatched timelines, and a lack of structured dialogue. But its impact can be significant: diminished enterprise value, eroded client trust, and missed opportunities for both parties.

At GCG, we help advisory firms navigate this critical inflection point with clarity and strategy. Here's what we've learned about the dynamics between G1 and G2—and how to create a succession plan that works for everyone involved.

The Root of the Disconnect

The misalignment between G1 and G2 isn’t about values—it’s about expectations.

G1 advisors have built the firm from the ground up. Their identity, reputation, and retirement security are deeply tied to the business. For many, succession means letting go of control, brand, and decision-making—something that understandably takes time.

G2 advisors, on the other hand, are ready to lead. They’re often younger, entrepreneurial, and hungry for opportunity. But without a clear path to equity, leadership, or autonomy, they may feel stuck in limbo.

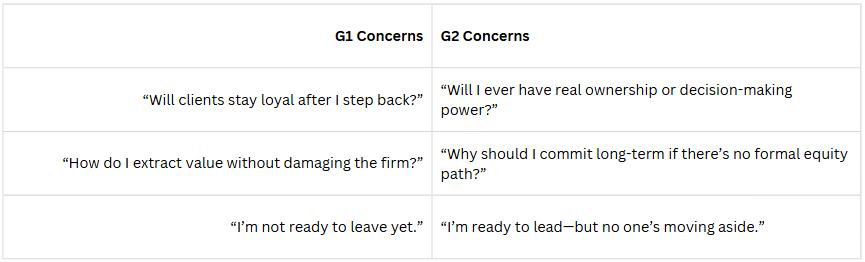

Here’s where it breaks down:

Both sides care about the same outcomes—client continuity, firm growth, personal legacy—but without alignment, the succession process slows to a crawl.

The Risks of Delaying Alignment

Succession misalignment isn’t just a cultural issue—it’s a business risk.

If a clear and actionable succession plan isn’t in place, firms face several challenges:

Lost Enterprise Value: Advisory firms with no defined successor or handoff structure often command lower valuations. Buyers view uncertainty as risk, and uncertainty lowers multiples.

Next-Gen Attrition: If G2 advisors don't see a clear future within the firm, they'll eventually seek opportunities elsewhere—often taking client relationships with them.

Client Disruption: Clients care deeply about continuity. If they sense instability or leadership friction, trust can erode quickly—especially for multi-generational clients.

Cultural Fractures: A lack of alignment around mission, strategy, or leadership style can create division within teams, leading to inefficiency and disengagement.

What Alignment Really Looks Like

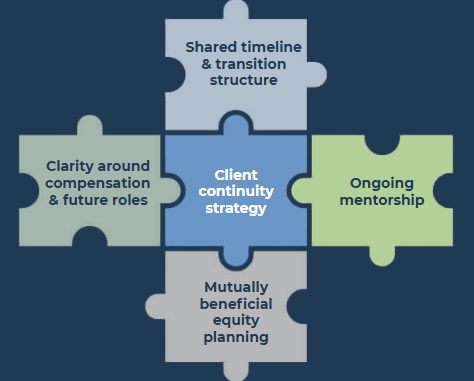

True alignment doesn’t mean G1 stepping away overnight—or G2 taking over by force. It means crafting a transition that’s structured, gradual, and beneficial to both sides.

Here’s what that looks like in practice:

Shared Vision: G1 and G2 must be in agreement on where the firm is going and what it should stand for. This includes agreement on client service philosophy, growth strategies, and firm culture.

Defined Timeline: Ambiguity breeds frustration. A rough timeline—reviewed annually—helps both sides understand when transitions in ownership, leadership, and compensation will occur.

Equity Pathways: Next-gen advisors need more than verbal assurances. They need visibility into how ownership can be earned or acquired—and what the financial terms will be.

Role Evolution: Succession isn’t binary. It’s a process of gradual role shift. That means clearly defining how G1's role will evolve (e.g., into a Chairman or rainmaker role) while G2 assumes operational leadership.

Compensation Clarity: Transparency around current and future compensation—especially as it relates to equity, profit distributions, and performance incentives—is critical to avoid resentment and confusion.

How GCG Supports G1-G2 Transitions

At GCG, we’ve built an M&A and succession platform specifically designed to address these pain points—because we believe succession shouldn’t mean compromise. It should be an opportunity to unlock growth, continuity, and enterprise value.

Here’s how we help:

Valuation & Monetization Support: We help G1 advisors understand the full value of their firm—and how to extract liquidity without sacrificing control or disrupting clients.

Structured Equity Planning: We work with G2 advisors to establish clear equity tracks, financing support, and acquisition modeling so that ownership becomes achievable, not aspirational.

Succession Coaching: We facilitate conversations between G1 and G2—often acting as an objective third party—to help both sides get aligned on leadership, timing, and operational shifts.

Back-Office & Infrastructure: As advisors move through a transition, we take on operational burden—compliance, technology, marketing, HR—so that both generations can stay focused on clients and growth.

Culture Preservation: Most importantly, we help ensure the firm’s unique culture, client experience, and planning philosophy remain intact—whether the founder is still involved or has stepped back.

Real Talk: It's Okay to Feel Stuck

If you're a G1 advisor struggling with how to let go—or a G2 leader unsure whether to stick around—you’re not alone. These transitions are emotional, high-stakes, and complex.

But with structure, transparency, and the right partner, they can also be incredibly rewarding.

You can:

Transition on your own timeline

Protect your clients and staff

Maximize your firm’s value

Create a true win-win succession

Let’s Build the Bridge

Whether you're just beginning succession conversations or already facing internal misalignment, the time to take action is now. Waiting won’t make it easier—and it could cost you more than just revenue.

At GCG, we’ve helped dozens of firms create succession plans that don’t just “work”—they build lasting legacies.

Ready to start that conversation? Let’s explore what the next chapter of your firm could look like—with a partner who knows how to get you there.